Riding the Storm: Could Bitcoin be a Safe Haven When Things Get Scary?

In today's interconnected world, geopolitical events can ripple through global markets, causing traditional assets to fluctuate unexpectedly. Investors seeking a "flight to safety" often turn to bonds or gold during times of turmoil. However, a new contender has emerged—Bitcoin. This digital currency, operating outside conventional financial systems, offers unique appeal as an alternative asset during geopolitical upheavals that the world has yet to fully appreciate.

Understanding Bitcoin’s Place as an Alternative Asset

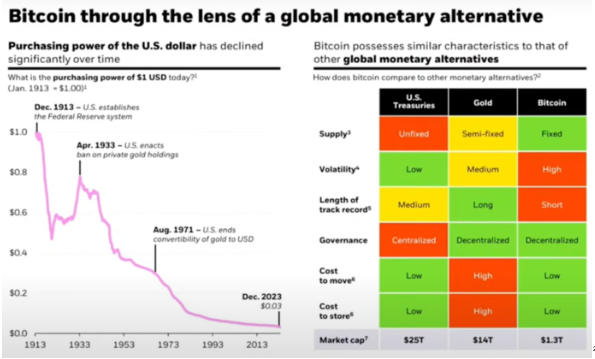

Bitcoin stands apart from traditional financial assets for many reasons. It was created as a decentralized currency, operating independently of central banks and government policies. This independence makes Bitcoin particularly attractive during geopolitical events that might otherwise destabilize traditional financial systems. Unlike bonds or stocks, which are tied to the policies and directives of specific countries or companies, Bitcoin transcends national borders and political influences.

Millennials and high-net-worth individuals are increasingly viewing Bitcoin as a hedge against geopolitical uncertainties. Its digital nature means it isn't subject to the same regulatory constraints as other assets, allowing it to function as a global currency. Unlike traditional forms of money that are limited by borders and subject to various governmental policies, this digital currency can be traded freely across international boundaries, offering users a seamless and efficient way to conduct transactions anywhere in the world.

Furthermore, Bitcoin's fixed supply and algorithmically controlled issuance make it immune to the inflationary pressures that can afflict fiat currencies during geopolitical crises. Bitcoin’s resilience during geopolitical turbulence is bolstered by its peer-to-peer technology. Without intermediaries, transactions are secure and transparent, offering investors a level of security not found in traditional finance. This aspect is particularly appealing to those wary of political instability impacting the integrity of their assets.

Historical Case Studies of Bitcoin in Geopolitical Contexts

Examining past geopolitical events reveals intriguing insights into Bitcoin's role as an alternative asset. For instance, during the Cyprus banking crisis in 2013, Bitcoin’s value surged as citizens sought alternatives to their failing banking system. This event marked one of the first times Bitcoin was perceived as a viable store of value amidst financial uncertainty.

Similarly, the Venezuelan economic collapse saw increased Bitcoin adoption as hyperinflation rendered the national currency nearly worthless. Venezuelans turned to Bitcoin for its relative stability and as a means to circumvent government controls.

Most recently, during the COVID-19 pandemic, Bitcoin demonstrated resilience while traditional markets faltered. The global crisis accelerated Bitcoin’s acceptance as a legitimate asset class, with institutional investors increasing their holdings. This shift underscores Bitcoin's growing recognition as a reliable investment in the face of global uncertainties.

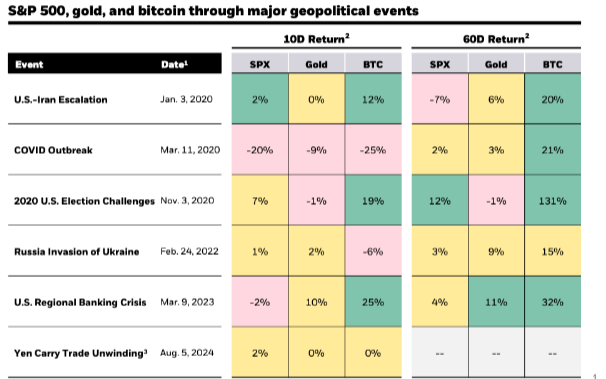

Asset manager, BlackRock, has begun speaking with its investors on the merits of Bitcoin within portfolio allocations and released the following chart illustrating how the S&P 500, Gold and Bitcoin have performed in response to geopolitical events. As you can see, while initially volatile during these times, Bitcoin tends to outperform the traditional equities markets and Gold after 60 days. One can conclude that since Bitcoin offers significant liquidity and access, investors are quick to react to geopolitical events through their Bitcoin. After the initial reaction to these events, Bitcoin’s properties of decentralization, heightened liquidity, global accessibility, and independence from local policies, become attractive to investors.

The Advantages of Bitcoin in Times of Geopolitical Turmoil

Bitcoin's independence provides investors with an asset that retains value even when traditional markets are in disarray.

Furthermore, Bitcoin’s liquidity is a significant advantage, allowing for easier transactions and the ability to quickly convert assets into cash. This liquidity ensures that Bitcoin can be readily used for purchasing goods and services or for investment purposes, making it a versatile option for various financial needs. Unlike real estate or other physical assets, Bitcoin can be easily traded on numerous global exchanges, allowing investors to quickly adapt their portfolios in response to geopolitical developments.

Another advantage is Bitcoin’s accessibility. With no need for intermediaries, anyone with internet access can buy or sell Bitcoin, providing a straightforward entry point for investors worldwide. This accessibility is crucial during geopolitical crises, as traditional banking systems may be impaired or restricted.

Strategies for Integrating Bitcoin into Investment Portfolios

For investors considering Bitcoin as part of their financial planning, several strategies can enhance its integration. Long-term holding, or "HODLing," is another effective strategy. Despite short-term volatility, Bitcoin has historically appreciated in value over extended periods. Investors with a long-term perspective can ride out market fluctuations, potentially reaping substantial gains as Bitcoin continues to mature and gain wider acceptance.

Date of Publish: 10-11-2024

(89) Comments